36+ massachusetts excise tax calculator

Web The excise rate is 25 per 1000 of your vehicles value. Web To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Pdf An Assessment Of Tax Compliance Level Of Small Enterprises In Ghana Lawrence Asamoah Academia Edu

Other helpful pages include information on exemptions filing methods and making estimated payments.

. Web 34th highest liquor tax. Ad Let Our Tax Calculator Tools Help You Understand What Your Tax Refund Will Look Like. Web Massachusetts imposes a corporate excise tax on certain businesses.

Learn if your corporation has nexus in Massachusetts and how to calculate corporate excise tax. The current rate is. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

After a few seconds you will be provided with. Get Rid Of The Guesswork And Accurately Calculate Your Tax Refund With Our Tax Calculator. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

Get the ins and outs on paying the motor vehicle excise tax to. Web Use our income tax calculator to find out what your take home pay will be in Massachusetts for the tax year. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged.

Web The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise. Web When you register your motor vehicle or trailer you have to pay a motor vehicle and trailer excise. Massachusetts excise tax on Spirits is ranked 34 out.

For example if an item costs 35 and the sales tax is 85 the total would be 35 298. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Corporate excise can apply to both domestic and foreign corporations.

The Massachusetts excise tax on liquor is 405 per gallon lower then 68 of the other 50 states. Box 9660 Boston MA 02114. Web Suffolk Registry of Deeds 24 New Chardon St PO.

Value for Excise x Rate 25 or 0025 Excise Amount. The excise due is calculated by multiplying the value of the vehicle by the. Web They apply when a homeowner sells real property for more than 100.

It is an assessment in lieu of a personal property tax. Web The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide. Massachusetts Income Tax Calculator 2022-2023.

Web In traditional retail taxes are charged as a single percent on a subtotal. Ad Avalara excise tax solutions take the headache out of rate determination and compliance. Web Motor vehicle excise is taxed on the calendar year.

If your vehicle is. These taxes are billed at the county level payable to the Registry of Deeds.

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

Excise Tax Calculator Suffolk County Registry Of Deeds

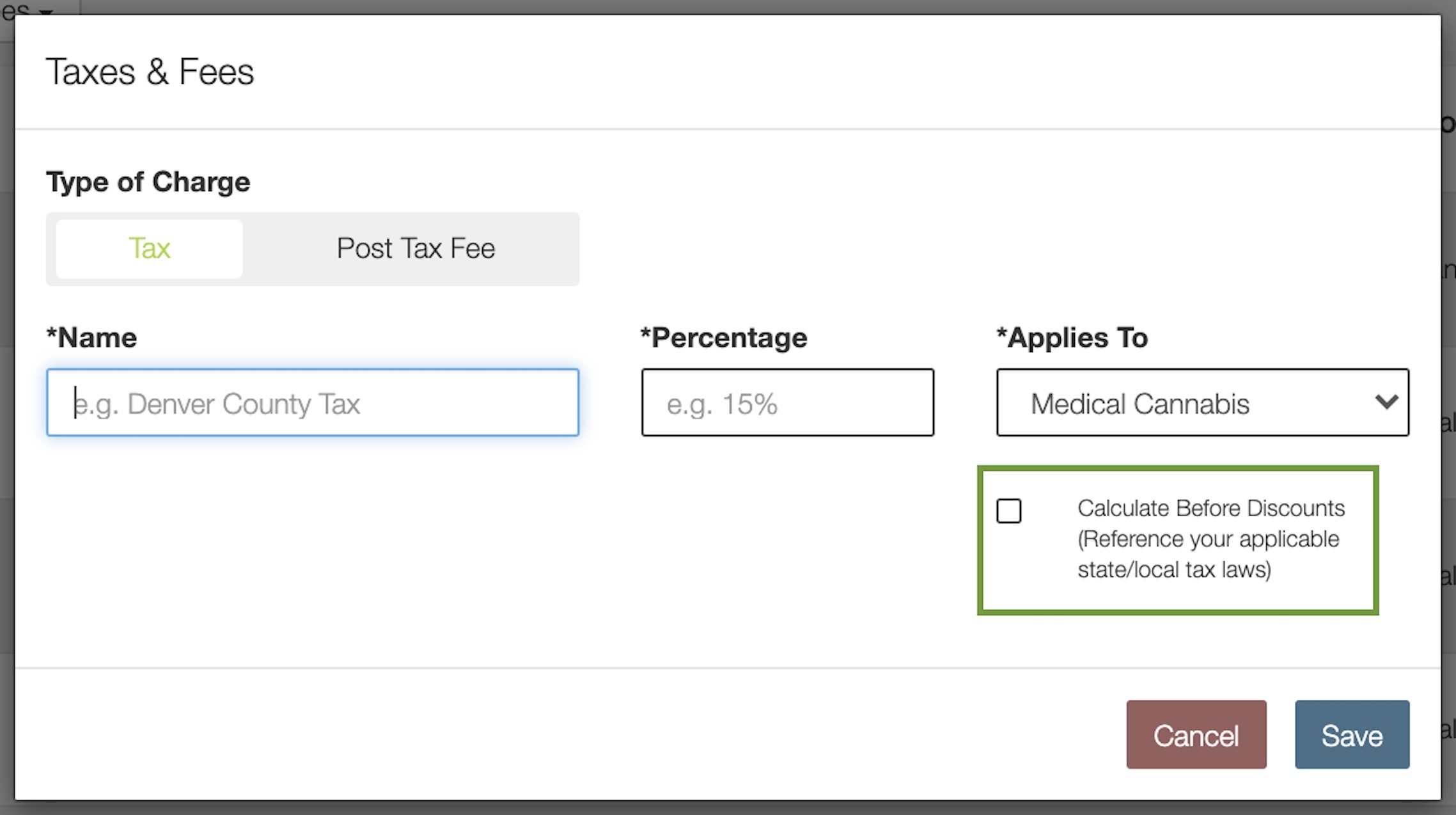

How To Calculate Cannabis Taxes At Your Dispensary

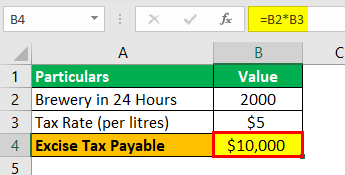

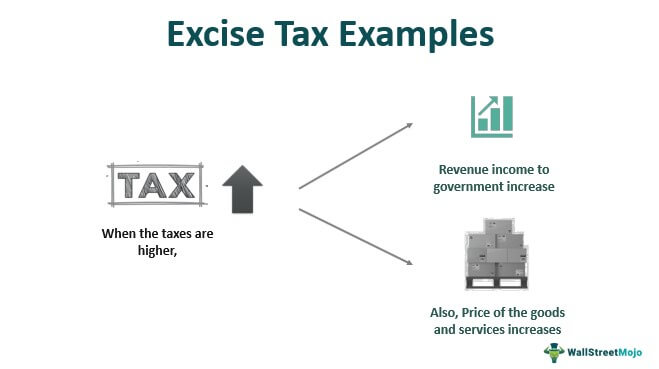

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Excise Tax Definition Boycewire

Lb1740 21matt Pdf

Ex 11 3 1 X2 36 Y2 16 1 Find Foci Vertices Eccentricity

Download Tobacco International 1995 Vol 197 Index Pdf

Amendment No 4 To Form S 1

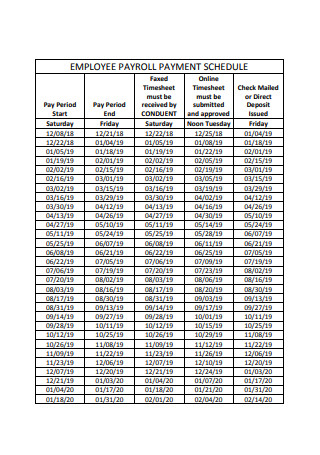

36 Sample Employee Payrolls In Pdf Ms Word

Excise Tax Examples Top 3 Practical Example Of Excise Tax Calculations

Calculating Motor Vehicle Excise Taxes Bridgewater Ma

Smart Money Moves Women 18 35 Years Old Start Investing Nearly One Decade Earlier Than Women Ages 36 Ap News

Excise Tax Calculator Suffolk County Registry Of Deeds

File Effective Federal Excise Tax Rate By Income Group 2007 Jpg Wikipedia

Haiboxing Remote Control Car 4wd Rc Car 1 16 36 Km H High Speed Rc Monster Truck 2 4 Ghz Racing Car Waterproof Off Road Car Toy Gift For Children And Adults Amazon De Toys

Motor Vehicle Excise Mass Gov